Fascination About Hsmb Advisory Llc

The Single Strategy To Use For Hsmb Advisory Llc

Table of ContentsOur Hsmb Advisory Llc PDFsFascination About Hsmb Advisory LlcSome Ideas on Hsmb Advisory Llc You Need To KnowHsmb Advisory Llc Can Be Fun For AnyoneGetting The Hsmb Advisory Llc To WorkUnknown Facts About Hsmb Advisory Llc

Ford claims to avoid "cash value or long-term" life insurance, which is even more of an investment than an insurance coverage. "Those are very complicated, included high compensations, and 9 out of 10 people don't need them. They're oversold since insurance policy agents make the biggest commissions on these," he says.

Special needs insurance coverage can be costly, nevertheless. And for those that choose long-lasting care insurance policy, this policy may make handicap insurance coverage unnecessary. Learn more concerning long-lasting treatment insurance coverage and whether it's appropriate for you in the next section. Lasting care insurance coverage can help spend for expenditures connected with long-term care as we age.

Hsmb Advisory Llc Things To Know Before You Get This

If you have a persistent wellness problem, this kind of insurance could wind up being crucial (Life Insurance St Petersburg, FL). Nonetheless, don't let it worry you or your bank account early in lifeit's usually best to take out a policy in your 50s or 60s with the anticipation that you will not be utilizing it till your 70s or later on.

If you're a small-business proprietor, take into consideration shielding your livelihood by buying business insurance. In the event of a disaster-related closure or duration of restoring, organization insurance can cover your earnings loss. Take into consideration if a significant climate occasion influenced your store front or manufacturing facilityhow would certainly that influence your income? And for how much time? According to a record by FEMA, in between 4060% of small companies never ever reopen their doors adhering to a disaster.

And also, utilizing insurance policy could often cost greater than it saves in the lengthy run. As an example, if you get a contribute your windshield, you may consider covering the fixing expense with your emergency situation financial savings as opposed to your automobile insurance policy. Why? Because using your automobile insurance coverage can cause your month-to-month costs to increase.

What Does Hsmb Advisory Llc Mean?

Share these tips to protect loved ones from being both underinsured and overinsuredand consult with a trusted expert when required. (https://filesharingtalk.com/members/593064-hsmbadvisory)

Insurance that is purchased by an individual for single-person protection or protection of a household. The specific pays the premium, instead of employer-based medical insurance where the company typically pays a share of the premium. Individuals might purchase and acquisition insurance from any type of plans offered in the person's geographic area.

Individuals and households might qualify for monetary assistance to lower the cost of insurance costs and out-of-pocket prices, yet just when enrolling through Connect for Health Colorado. If you experience specific adjustments in your life,, you are qualified for a 60-day duration of time where you can sign up in a private plan, even if it is outside of the yearly open enrollment period of Nov.

15.

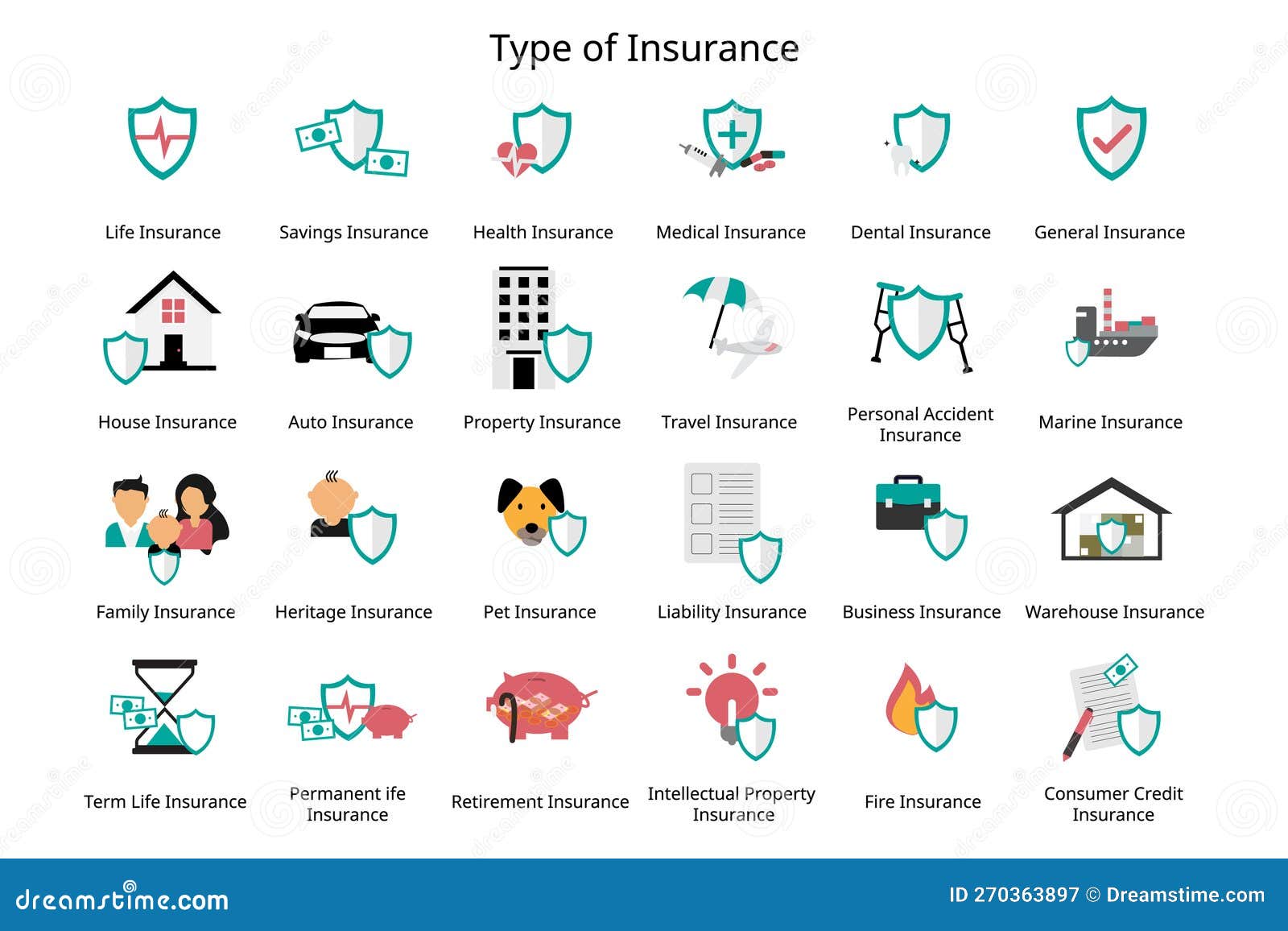

It might seem easy however comprehending insurance policy kinds can likewise be confusing. Much of this complication comes from the insurance market's ongoing objective to make personalized coverage for policyholders. In designing flexible policies, there are a variety to pick fromand all of those insurance coverage types can make it challenging to comprehend what a certain policy is and does.

A Biased View of Hsmb Advisory Llc

The most effective location to start is to discuss the difference in between the two types of standard life insurance policy: term life insurance policy and long-term life insurance policy. Term life insurance policy is life insurance coverage that is only energetic temporarily period. If you die throughout this duration, the individual or people you've named as recipients might get the cash money payment of the policy.

Several term life insurance plans allow you transform them to an entire life insurance plan, so you do not shed insurance coverage. Usually, term life insurance policy plan premium payments (what you pay each month or year into your plan) are not locked in at the time of acquisition, so every five or 10 years you own the plan, your premiums can increase.

They additionally tend to be less costly overall than whole life, unless you get an entire life insurance coverage plan when you're young. There are likewise a couple of variants on term life insurance. One, called group term life insurance policy, prevails amongst insurance coverage choices you may have access to with your employer.

The smart Trick of Hsmb Advisory Llc That Nobody is Talking About

An additional variation that you might have access to through here are the findings your company is supplemental life insurance., or burial insuranceadditional insurance coverage that might help your household in situation something unanticipated happens to you.

Long-term life insurance policy simply refers to any type of life insurance coverage policy that doesn't end.